http://www.bloomberg.com/news/2014-0...b-meeting.html

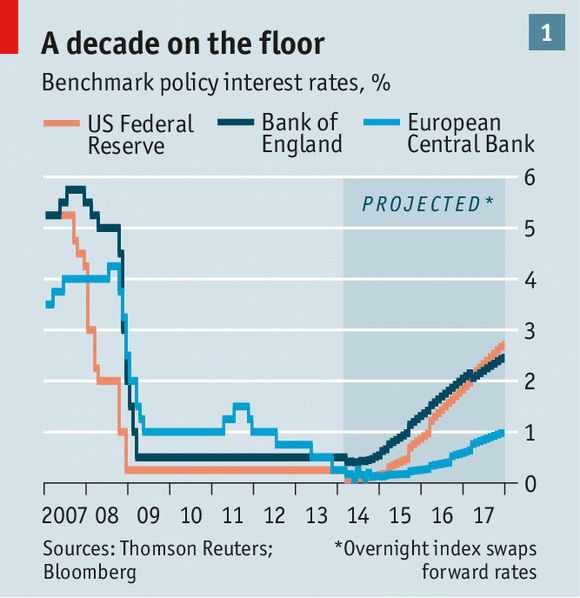

Euro volatility surged to the highest in a year and price swings in Treasuries rose to a two-month high as investors speculated on the extent to which the European Central Bank will ease monetary policy today.

Reply With Quote

Reply With Quote