Bitcoin smashes through US$6k mark

Oct 23, 2017

Currency's market value now US$100 billion - above or on a par with US blue-chip firms

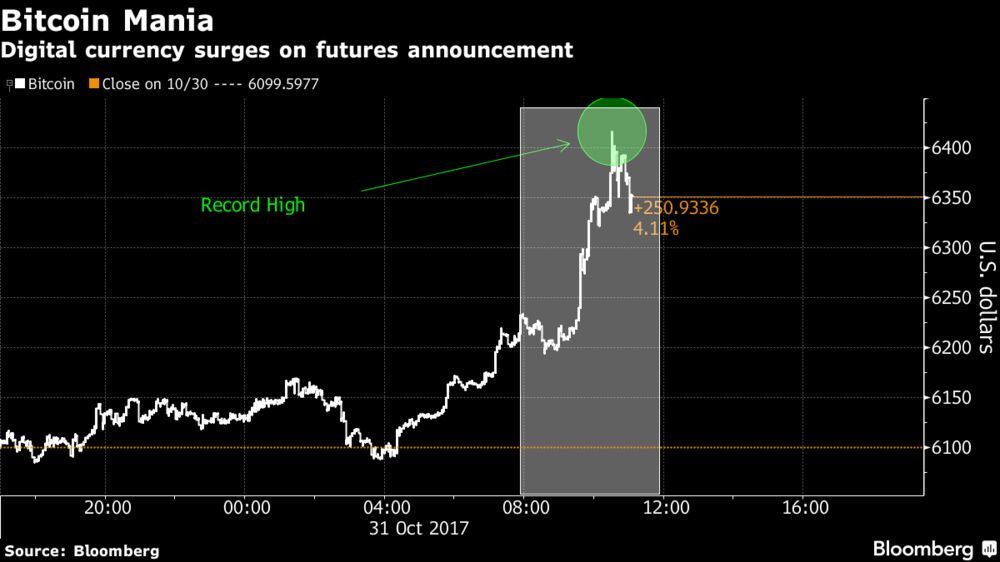

NEW YORK • Bitcoin surged to a record high of more than US$6,000 (S$8,167) over the weekend as investors continued to bet on an asset that some banks and policymakers have repeatedly warned is a "fraud" and a "bubble".

The original virtual currency has gained over 500 per cent this year, more than any other tradeable asset class, after ending last year at US$968.

On Saturday, bitcoin hit an all-time high of US$6,147.07 just a day after pushing through the US$6,000 mark, according to data from industry website CoinDesk.

This pushed up its market value to around US$100 billion - above or on a par with blue-chip companies in the United States.

Bitcoin, though, is very volatile, posting gains and losses as high as 26 per cent and 16 per cent respectively on any given day.

As a digital currency, bitcoin can either be held as an investment, or used as a foundation for future applications through the blockchain, its underlying technology. The blockchain is a digital ledger of transactions.

It is more scarce, though, than most people realise. The number of bitcoins in existence is not expected to exceed 21 million.

CNBC reported that much of the latest surge was due to another upcoming split in bitcoin known as a "fork". This will lead to the creation of a bitcoin offshoot called bitcoin gold. Holders of bitcoin will get some bitcoin gold when it is issued, essentially giving them free money.

Mr Alex Sunnarborg, founding partner of cryptocurrency fund Tetras Capital, told CNBC last Friday that bitcoin investors were betting on bitcoin continuing to perform strongly despite the split, as happened in August when bitcoin underwent a fork and bitcoin cash was created.

There were also rumours that China would reverse its ban on cryptocurrency exchanges.

Earlier this year, China ordered the shutdown of digital currency exchanges after it banned the practice of raising capital through the sale of tokens to the public in what is known as initial coin offerings (ICOs).

But many in the market believe the Chinese ban is temporary.

"China would not want to be left out of the digital currency market nor the development of blockchain applications in general," said Mr Jason English, vice-president of protocol marketing at Sweetbridge, a global alliance in Zug, Switzerland, that aims to use blockchain to create a liquid supply chain.

"As much as 60 per cent of the world's bitcoin mining is happening in China and, therefore, many of the large... investments in ICO projects have also been coming from cryptocurrency holders in China, whether directly or indirectly," Mr English added.

Bitcoin was helped by favourable regulation in Japan, which recently allowed companies to accept the cryptocurrency as payment.

Around 57 per cent of the trade in bitcoin on Saturday was executed in Japanese yen, CNBC reported, quoting industry website CryptoCompare.

The frenzy may continue.

An unscientific survey carried out by CNBC last week found that nearly half of the more than 23,000 people who voted said bitcoin is heading to over US$10,000.

REUTERS

Reply With Quote

Reply With Quote