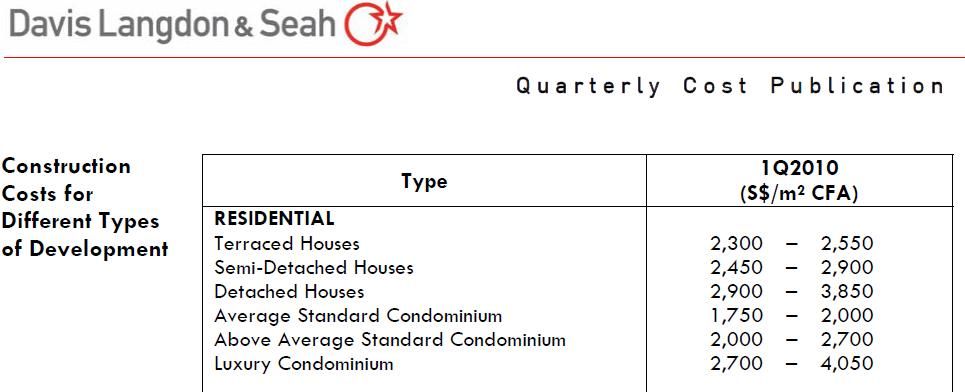

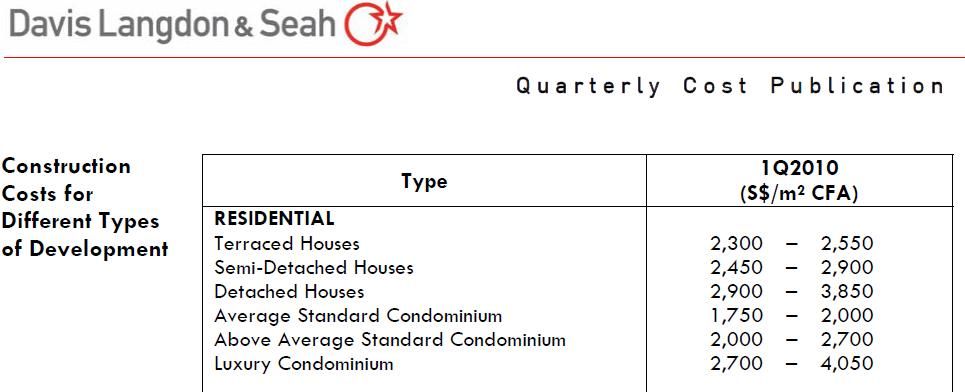

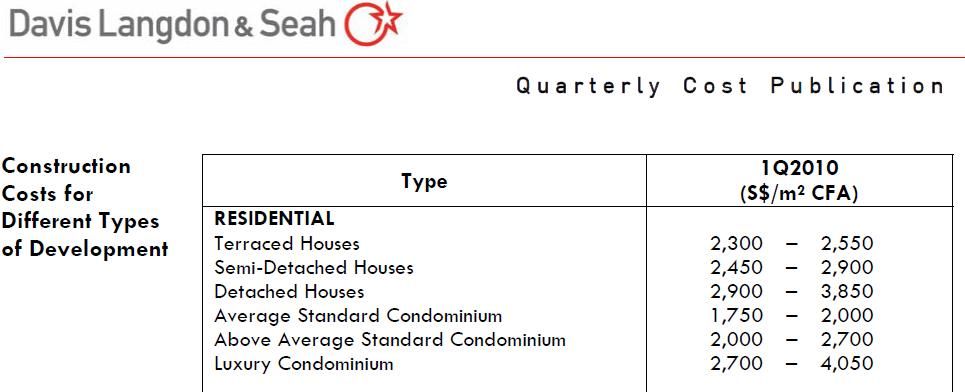

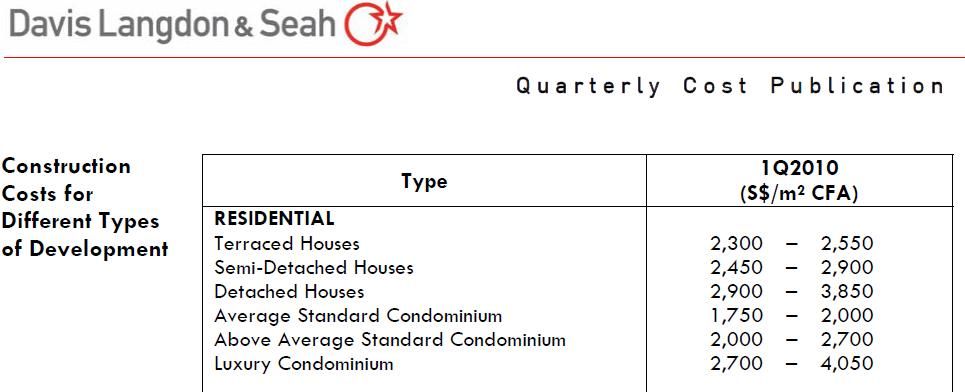

I hope whoever quoted these numbers should explain what it means. what does CFA include and exclude? unless of course he is just quoting blindly

I hope whoever quoted these numbers should explain what it means. what does CFA include and exclude? unless of course he is just quoting blindly

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Originally Posted by Ringo33

People who need to ask obviously do not know about construction, let alone costing. Go google and refer to the footnotes in L&S quarterly updates. Not going to spoonfeed you.

No point deflecting the topic.

Please let all the readers here know at what level of pricing you think that George Lim signed his construction contract for his GCB. 2010 prices ? OR 3Q 2012 prices?

As you can see, when confronted with the same numbers they quoted, they back off, they start asking you to go find out information which he doesnt even have a clue.

If thats not enough, he started diverting the discussion into asking silly question like when did developer of Binjai GCB conclude this contract for rebuilding.

I guess you guys already know the reason why I always avoid replying to certain landed property owner in this forum.

Again, dont let people tell you that cost of constructing modern GCB is as cheap as mass market condo because it isnt. GCB is a trophy asset, and owners always want theirs to be the best.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Hi Ringo...Ringo, don't be stubborn. Proper-t has already given you realistic data on the construction costs of various types of residential properties, including the GCB.

From the table, you know how much it is going to cost based on the built-up area of the house unless your expectation is so high that you want your whole house to be gold plated...

Originally Posted by Ringo33

Albeit a bit long winded, but when you start to resort to these kind of stamtents, I know you have conceded and realised that you have no counter to the facts that I have posed before you. Your notions about price and value and rich foreigners supporting landed owners have provided some entertainment though. Its not easy to throw in the towel and admit defeat which is why perhaps you have worded it in such a way to save face but no matter, now, serious people here can get on with discussing landed matters in a rational and factual manner.Originally Posted by Ringo33

Originally Posted by MLP

I have eyes to see the table, I am just asking him (for the sake of clarification) what does CFA in that table include and exclude. Does it mean construction the bare building or does it include fitting out the entire GCB.

If construction cost (including fittings) of today mass market condo is around 350psf, do you have reason to believe that constructing a modern GCB can be at the same price?

perhaps you can try going down to kitchen culture and ask how much does it cost to retro fit a kitchen in GCB.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Based on your statement below, it is clear that you have never built your own landed property before. So I think it is no point in talking to you any further.

Originally Posted by Ringo33

lets not play all these cheap trick shot about what I know what you know. its like your word vs mine. really pointlessOriginally Posted by MLP

If you have reason to believe that construction cost for modern GCB could be done for $350psf then perhaps you could explain how

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

You have eyes to see my table but don't bother reading your own link you have posted. Who is the one blindly posting? Even more ludicrous when you ask someone to explain something when the answer is right under your nose.Originally Posted by Ringo33

1. Go click on the link and read the footnotes below. CFA miraculously appears.

2. Do you see the source of the data at the top left corner ? Langdon & Seah who btw is the same source as the table I provided so assumptions are the same.

3. Could you point out to me where you derive that $350 psf construction cost includes fittings? Please define fittings.

4. Do you think that the 3Q 2012 construction cost is at the same level as 2010?

uOriginally Posted by Ringo33

Last edited by proper-t; 28-02-13 at 17:34.

Appreciate if you could just stick with your table and dont muddle your table with the link I posted.

When you post a table like this, pleae post the link to the source and dont just cut out what you want to see and ignore other information.

And yes, what does the CFA in the table mean?

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

What do you think the below statement is for?Originally Posted by proper-t

do remember to read the fine print to get a better understanding of what you are comparing.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Are you talking to yourself? Why bother helping people if they don't want to help themselves? If you have taken the time to read the fine print in your own link, then you would know what CFA stands for.Originally Posted by Ringo33

Its quite laughable that you make this statement as someone who brings up 3Q2012 data to compare against 2010 data does not seem to grasp what ' a better understanding of what you are comparing' actually means.

This is what I call a desperate and ridicules attempt to make himself sound knowledgeable.

Honestly if I didnt read what I have posted, why would I ask reader to read those fine print?

Plus, does he even know the there is not standard definition for CFA in report on cost estimate?

So my question back to him again is, what is the definition of CFA in the table he posted earlier? And why didnt he post the entire report?

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

I can understand why you are making such a big deal about CFA because you really have no clue on how to tackle the question on why you are using irrelevant 3Q 2012 data to compare with 2010. As if the readers here really care about CFA.

It is very clear that you called bullman out on his estimated profit for the binjai bungalow sale and construction cost figure and when I brought conclusive data to prove you wrong, you cloud it up with 3Q 2012 figures which doesn't even show construction cost for detached houses.

You can spare yourself the embarassment. Just continuing on will reveal to more readers what your true character and intentions are. History has shown in this forum that people who make rude remarks and try to talk down the market end up being disgraced and fade into obscurity. Its your choice.

Anybody who is interested in find out more information about construction cost, you can read this article. And remember to read those fine print or foot note so that you know what is the meaning of CFA.

http://rlb.com/rlb.com/pdf/research/...ember_2012.pdf

Lets not let those who are blinded blind you further.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

The binjai bungalow was under construction in 2010 and TOP in Jun2011.

We are looking at the construction cost back in 2010.

Why are you showing us figures as at 3Q 2012?

Can already predict what is coming.

According to URA website, date which permission was granted was on 28 Sep 2010, so I would presume the construction can only start after that date.

P230210-34G2-Z000 28-Sep-10 Written Permission ES20100223R0215 MK16 99978L 68 BINJAI PARK PROPOSED ERECTION OF A 2 STOREY DETACHED DWELLING HOUSE WITH A BASEMENT & SWIMMING POOL

Does anyone know where did Proper-T got the idea that TOP for 68 Binjai Park was Jun 2011, or did he made up the date himself?

For those interested to know the cost of construction in 2010, you can also refer to this. Which according to the article, the cost ranges from $3100 to $5050/m2, very little different from the cost in 2012.

http://rlb.com/rlb.com/pdf/research/...ember_2010.pdf

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Address : 68 BINJAI PARK

Site Area : 1,285.2 m2

GFA : 1,333.46 m2

Purchase Price : $15,850,000

Stamp Duty : $470100

Construction Cost : est. $5050 / m2 x 1333.46 = $6,733,973

Other Cost* : $3,000,000

Total Cost = $26,054,073

(*) Legal and professional fees Development charges Authority fees Finance costs Loose furniture, fittings and works of art Tenancy work Site infrastructure work Diversion of existing services Green Mark Cost Premiums Resident site staff cost Models andprototypes Future cost escalation Goods and Services Tax.

Sold (27-Mar-12) : $31,000,000.

Estimated Profit : $4,945,927 (excluding agent commission)

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Wow...Finally doing some real research but to no avail.

TOP Jun 2011

Two Freehold GCBs Sold One For $60.6m, The Other For $31m

By MrProperty.SG On 13 April, 2012 · Leave a Comment

Two Good Class Bungalows (GCBs) have been transacted recently one at Ridout Road, which is said to have fetched about $60.6 million, or $1,490 per square foot (psf), on a land area of 40,679 sq ft, and another at Binjai Park, which has sold for $31 million, or $1,550 psf. Both bungalows are freehold.

In absolute price quantum, the $60.6 million for the Ridout property, which is near Holland Road, is the highest fetched for a GCB since December 2010, when 3 Leedon Park changed hands at $61.4 million.

The two-storey bungalow at Ridout Road is said to be more than 20 years old. It has five bedrooms, a tennis court and swimming pool. Its seller is former Goldman Sachs banker Thomas Chan, who last year gained control of the property following the conclusion of a long-running legal battle between the former owner Agus Anwar and another party to whom Mr Anwar had earlier granted an option.

Mr Chan picked up the property for $37 million based on an option granted to him in 2009.

In the latest transaction Mr Chan is understood to have sold the property to Tecity Group, which is controlled by the family of the late OCBC chairman Tan Chin Tuan. The site can potentially be subdivided to accommodate redevelopment into two GCBs.

The Binjai Park bungalow, which sits on 20,001 sq ft of land, received its Temporary Occupation Permit in June last year. It was sold by GCB investor George Lim, who developed the property.

The bungalow has attained the Building and Construction Authoritys highest eco-friendly award, the Greenmark Platinum Award. The house features 214 solar panels on the roof, uses recycled rain water and LED lighting.

All glass windows and doors have double glazing, which cuts down the heat and noise. It also utilises chlorine-free pool sanitising equipment. The bungalow was designed by Lim Hong Kian of Designshop Architects.

It has six bedrooms, a gym, home theatre, steam room, lift, and dehumidifiers in all rooms. The bungalow has a gross floor area of about 14,300 sq ft spread across two storeys and a basement

The costing and construction contract would have been firmed up way before the written permission which means that the construction cost figures in your Dec report are unlikely to have been used. A more accurate estimate would be the Q1 construction figures.

Originally Posted by Ringo33

1. Why are you using GFA when the report specifically states 5050/m2 CFA?

2. Please explain how you derived other cost?

3. As explained, the figures in your Dec report would not be applicable as the constuction contract would have been signed way before 3Q 2010. Why are you using 5050/m2?

Last edited by proper-t; 28-02-13 at 22:50.

After going through the above example I hope you people are convinced that URA figures tracking landed price index is not a good representation of actual price rises or profit, as they do not capture the cost of sale (in this case I will include rebuilding A&A etc). From this example, URA will capture this transaction as 15m profit, but to the seller, he should be looking at around $5m.Originally Posted by Ringo33

When something is too good to be true, it usually is.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

oh dear...the chart again..I suppose that is your last refuge when you have nowhere left to hide and can't answer my questions

As I have stated, selective info doesn't prove a thing. I have already given an example of a transaction where a landed was sold for a good profit without any reno, A&A/reconstruction.

Please give substantive evidence that ALL or even a significant no. of the landed transactions in the URA index are inflated via reno, A&A or reconstruction costs?

If you can't, then your statement has no basis and its just your word against mine.

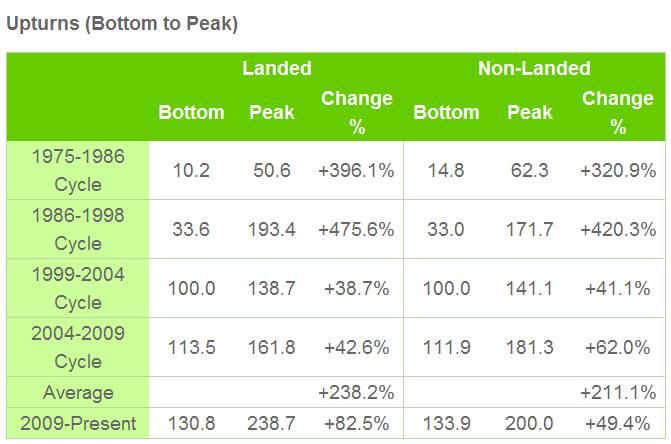

Dont let people BS you that landed prices has risen by 82.5% since 2009, because the same guy that BS you is tell me its around 32%.

72 Frankel Avenue - bought in Mar/Apr 2010 for approx $3.2m

Left it in original condition and didn't spend a cent on any reno or A&A/reconstruction.

Sold in Apr 2012 for $4.34m

Gross profit = $1.14m just for holding.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

This kind of thinking is not surprising from someone who :

Thinks that a single transaction is representative of the entire batch;

Has problems differentiating between price and value;

Thinks that landed owners needs to be supported by rich foreigners.

Wonder why he is suddenly posting all these other inane 'distractions' and not tackling the questions I asked in earlier posts ?

Again, you are drawing the incomplete/wrong conclusions. The run-up in landed prices from start 2009 Q1 to end 2010 Q1 was the steepest. The report that you quoted actually computes from 2009 Q1.Originally Posted by Ringo33

Its really astonishing that you seem ignorant of this fact as you have posted that chart of yours numerous times, and its glaringly obvious from there.

In the 72 Frankel Avenue case, the % increase would have been more, in the region of 65-75% if the full run up in prices which starts from 2009 Q1.

You are making one very unrealistic and incorrect assumption that all landed prices (be it new or old, cluster detach semi-d etc) are moving along at the same rate all the time, which we all know by now is not true because one of the main underlying support for the price increase we are seeing in landed property are contributed by owner or developers rebuilding, A&A or subdividing old landed property and resell or revalue them as new.Originally Posted by bullman

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

According to the attached report, the estimated that cost of construction a detached house (excluding many other cost - see footnote) is around $3100 to $5050 /m2 and this is based on CFA not GFA (which I presume will be higher). This is a huge contrast to your exaggerated estimate.Originally Posted by bullman

So based on your experience in landed property, do you think the report is inaccurate?

http://rlb.com/rlb.com/pdf/research/...ember_2010.pdf

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Hi Ringo...Ringo, what are you trying to prove? When we read a report saying that landed property prices have gone up 82.5%, that will mean "ON THE AVERAGE" the prices have gone up by that much. Obviously, some landed houses have gone up more and some are less. Just like any properties, the valuation of a landed house depends on many factors, both positive and negative.

So you can still buy a landed house at a very reasonable price (based on psf) if you look hard enough and don't mind some of the negative factors. Instead of wasting your time trying to talk down landed property prices, go and get yourself one landed house and be happy.

Originally Posted by Ringo33

seems like I'm not alone, the more we talk the more we vomit blood as the ears are shut. now he say we cannot assume that landed has run up steeply but keep telling ppl dont buy landed as it has risen more than anything else and it will crash hard.

what kind of contridiction is this...but he can go on and on and on....

anyway not going into this anymore...

Originally Posted by MLP

82.5% is average? so some might be more than 100%?Originally Posted by MLP