wealth of a person is not measure by the size of the house or the car they drive because we all know that many people in Singapore are leveraging themselves to their neck just to maintain a certain lifestyle.

condo quantum is small and shock in interest rate can easily be cover by rental and pool of condo buyers is also much larger because there are no restriction on PR or foreigners

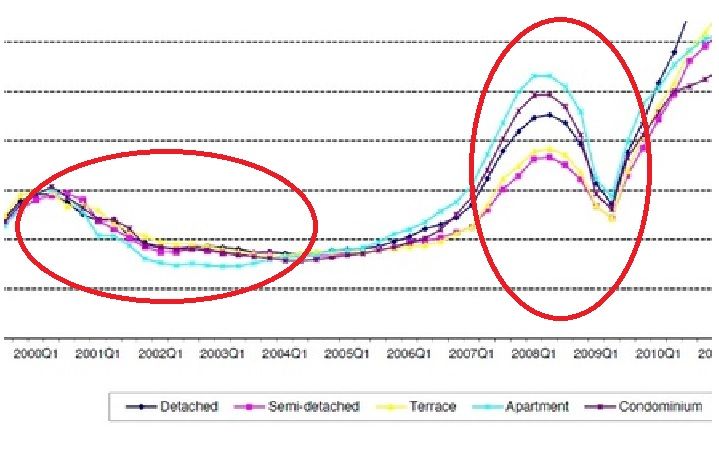

If you look at the chart, condo prices already started to cool, while landed prices are still going crazy, all are thinking that 20K new citizens are carrot head loaded with money and no brain.

reason why condo price will not be affect that much because condo market already started to cool down, while landed property owners are still chasing after the bubble.

Just look that the pattern of the chart in 1997 and then look at the current chart. notice any similarity?

BUBBLE is coming. if you buy now, you will regret for the next 15 years.

"Never argue with an idiot, or he will drag you down to his level and beat you with experience."

Reply With Quote

Reply With Quote