By Gerald Tay (guest contributor)

I can’t help it. I read some bad advice recently and have to say something. I’ll try to keep it positive, but my tongue is already bleeding from biting it. In Singapore, inflation is on the rise, but this one thing is still offered for free – advice. It’s really funny to observe people taking it so lightly. But only the advice that makes you profit in reality (i.e. real profit not imaginary) is good, otherwise it’s useless or even disastrous.

Most people don’t know the difference between advice from rich people and advice from sales people. Most get their financial advice from the latter — people who profit even if you lose. In this post, I explore why one recently written article by ‘experts’ (sales people in disguise) will prove disastrous for both average investors and home buyers. Your task is to look for any hidden agenda.

An example of bad property advice

The article, Why 2014 is going to be the best year in buying property, appeared in Yahoo Singapore News on 16th April, 2014.

The article aims to sell readers three ‘benefits’ of buying a suburban condo today:

1. Because You Can Afford a Better First Home Than You Realize

BAD ADVICE: “The monthly salary needed to get the most out of your property purchase is $10,000 to $12,000. I know, it’s not the easiest number to reach. But if you and your spouse can climb your way to this number, you’ll be in a prime position to afford a fantastic first home.”

BAD ADVICE: “According to ERA key spokesman Eugene Lim, depending on whether your income is fixed and your finances are well within the Total Debt Servicing Ration (TDSR) framework, you should be able to afford properties priced between $600,000 and $1.2 million.”

REALITY CHECK: Having a combined income of $10,000 to $12,000 for married couples does not justify a worthwhile reason to own an expensive suburban condominium as their first home. The purchase is more conspicuous spending than financial prudence.

Most married couples I know simply live from pay-check to pay-check servicing expensive home and car loans to keep up with society’s expectations. If one spouse loses his/her job, their financial position gets tougher with kids along the way.

Suburban condos that are priced lower than $1 million today are very small units, either the 1-bedders or 2-bedders, spaces that may be too small for a married couple who wants to start a family. Today’s $1.2 million condos do not get you much space either, only larger mortgage payments. Even at a low 1.5% interest rate for a 30-year loan tenure on a 20% down-payment, a couple would have to fork out $3,300 every month. With interest rates at 3.5%, the mortgage payments jump to $4,300 every month.

REALITY CHECK: Total Debt Servicing Ratio (TDSR) guidelines are meant to serve the business interests of a lending bank to a borrower. They are not meant to serve as financially prudent advice for buyers.

Most couples with a combined income of $10,000 to $12,000 would do a lot better financially buying less expensive re-sale HDB flats instead. They could use that savings to acquire financial freedom instead of paying through their noses for a cage in the sky.

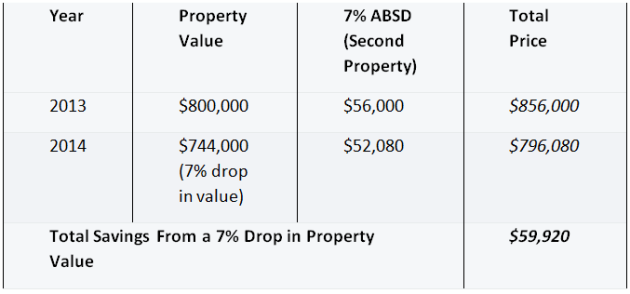

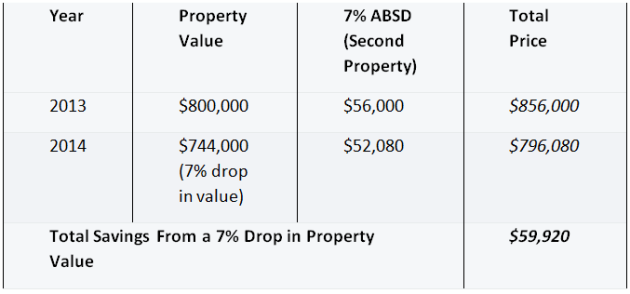

2. Because Falling Prices Make the Additional Buyer’s Stamp Duty (ABSD) Less Scary

BAD ADVICE: “What a 7% property drop would save you on ABSD – As you can see, falling property prices take the “bite” out of ABSD when it comes to purchasing a second or third property. You’ll even be able to save money, as the example above shows.”

BAD ADVICE: “If property prices drop by 7% to 10% over the course of 2014, which everyone expects will happen – the pain of ABSD actually gets nullified.

REALITY CHECK: I have received many emails from readers telling me they have gotten a great price on a property. One particular lady approached me excitedly about discounted developer prices for a project called Sky Habitat in Bishan recently.

“How good is the price?” I asked

“During launch, developer is selling units at $1,600 to $1,800 psf. And now they are selling only at $1,300 psf. What do you think? Is it a good buy?”

“How would I know?” I replied. “All you have given me is the price.”

“Yes!” she squealed. “Now my husband and I can afford it.”

Only cheap people buy on price. Just because something is cheap or cheaper doesn’t mean it’s worth the cost.

One of my most basic money principles: I buy value. I will pay more for value. If I don’t like the price, I simply pass. If the seller wants to sell, he will come back with a better price. I let him tell me what he will accept. I know some people love to haggle; personally, I don’t. If a person wants to sell, they will sell. If I feel what I am buying is of value, I’ll pay the price. Value rather than price has made me rich.

Whether you pay ABSD or not constitutes a small part of what’s important in the scheme of things. Looking at the overall picture of what really constitutes a quality investment is a better gauge than simply looking at savings and price alone.

REALITY CHECK: Banks do not lend money to borrowers because they’ve bought the property at discounted prices or cheaper than their neighbour.

Banks lend solely based on the ability of the borrower to repay the loan. They don’t care if you bought the property with great savings by buying at discounted prices, cheaper or less expensive than your neighbour.

The bank’s only concern is, “Is the borrower able to service his/her loan on time?”

3. Because You’ll Be Able to Purchase Additional Properties with Little or No Financing

BAD ADVICE: “But there’s another way to purchase property in this buyer’s market – buying property from new launches through the progressive payment scheme.”

BAD ADVICE: “In most new launches, units priced below $1 million are usually purchased quickly. That’s because payment for new developments is made progressively, allowing buyers who aren’t severely affected by tighter loan rules to buy smaller units with cash instead of financing larger units.”

REALITY CHECK: If a buyer decides to buy a smaller unit because he/she is severely affected by tighter loan rules, it simply shows he/she may already be overstretching on finances, never mind a smaller unit.

This is the equivalent of saying, “If I cannot afford a Ferrari, I will throw my money modifying a cheap Toyota Vios to look and sound like one.”

“If I cannot afford a second property in Singapore, I’ll just throw my money into a cheap overseas property I’ve never seen before.”

Many ‘experts’ have given advice that suggests buying with no or little money down is more important than buying a quality investment property. In your overall investment analysis, how you finance the property isn’t as important as buying one that will be a sound, long-term investment, i.e. quality properties that have positive cash-flow. Even if it’s 100% financed, a bad property is a bad property!

When you look at the noise out there, you will come across numerous suggestions on what you should do, and have to determine the legitimacy of every idea presented to you. It’s often not easy to differentiate between good advice and a bad advice, so take care before you act on it.

Reply With Quote

Reply With Quote