http://propertysoul.com/2014/10/27/o...operty-survey/

Only 5 percent say they are buying now: Property survey

October 27, 2014

With developers rushing to launch or re-launch new and existing projects ahead of the festive season, the Saturday after the Hari Raya Haji public holiday saw twenty-two property advertisements in the Straits Times marketing local property projects.

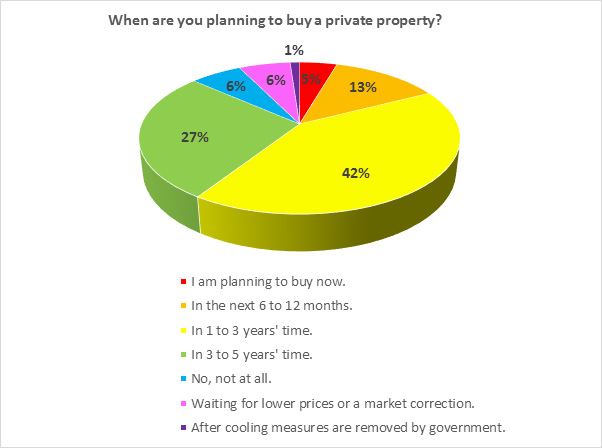

Despite aggressive marketing by developers, the PropertySoul.com Blog Readership Survey revealed that only five percent are saying that they are planning to buy a private property now.

The property survey asked 355 respondents when they are planning to buy a private property. It was conducted online between September 5 and 23 this year on readers of PropertySoul.com.

Prefer to rent than buy

This is despite the fact that 10 percent of respondents are currently renting. Among them, only 5.6 percent are planning to buy. The result shows that most renters still prefer to continue renting instead of taking the risk to buy now for fear of prices dropping further after their purchase.

A total of 13 percent of respondents have no definite timeframe to buy a private property. Among the non-buying group, half of them have no intention to buy at all. Another half are waiting on the sidelines and expecting to buy at lower prices. Some are even anticipating a recession that may result in a major market correction before they will consider buying again.

Loss of market confidence

Contrary to the common belief that the market is affected by the property cooling measures, including additional buyer or seller stamp duties and the total debt servicing ratio (TDSR) framework, only one percent of respondents are saying that they are waiting for the uplift of buying restrictions by the government before considering buying again.

The results demonstrated that it is the eroding confidence in the property market, not the cooling measures, that is to blame for the weak demand in private residential properties. With no sign of recovery under a softening property market, potential buyers are adopting a ‘wait and see’ approach on property purchase.

The opportunistic and overzealous buyers seen in the last few years are gone. It proves that the fad in properties is not sustainable when properties with historically-high prices can no longer prove their value. Once high-price-low-yield makes property investment unattractive, investor appetite will naturally shrink.

Worsening of oversupply

The worsening imbalance between supply and demand is adding up to the problem. According to the URA data, 37.7 percent of uncompleted private residential units (excluding ECs) remained unsold as of 3rd Quarter 2014. There is now a total of 97,180 private housing and EC units in the overall pipeline supply. The influx of 20,852 units in 2014 and 23,769 units in 2015 to the market will definitely create a housing glut in the next few years.

That said, there is still good news that a significant number of survey respondents (42 percent) plan to buy in one to three years while another 27 percent plan to do so after three to five years.

The demand from first-time buyers, upgraders and investors will always be there. The current situation is a see-saw battle between the buyers and sellers. It will persist for some time and little can upset the balance unless there is a major crisis happening in the market.

Reply With Quote

Reply With Quote