http://propertysoul.com/2016/04/05/uncertain-times/

Property investment in uncertain times

April 5, 2016

Last Sunday was my third time speaking at the SMART Investment & International Property Expo. It was very touching to see so many of my blog followers and readers there. Thank you!

The unbearable uncertainty of being

When the organizer asked me to talk about ‘Property Investment in Uncertain Times’, I thought it was a great topic.

You see they can say property investment ‘in a slow market’, ‘during a market downturn’, or ‘when the market is bottoming out’. But I prefer the word ‘uncertain’. It implies that we are all facing uncertainty now.

Many believe that the worst has yet to come. My sixth sense tells me that we are brewing a perfect storm, similar to 1996 after the introduction of anti-speculation measures, the Asian Financial Crisis struck.

Just over the weekend, Donald Trump said US is heading for a massive recession. It is just a question of when. But they will support the stock market by hook or by crook until the US Election in November, aren’t they? And from now till then, who knows what will happen.

Sometimes things happen when people least expect it. Sometimes nothing happen when everyone expect it to come. Maybe there is nothing disastrous on its way. But that strong sentiment of uncertainty is enough to hold property buyers back; lengthen the see-saw negotiations between buyers and sellers; make banks more conservative in approving loans; and continue that boring quarterly reports of 0.5 percent to 1 percent price drop that might linger for years.

Being defensive in uncertain times

When I was about to touch on strategies in uncertain times, I noticed that more people were joining the audience. The 70 seats had already filled up and late comers had to stand behind.

“Property investment strategy in the Year of the Monkey is defensive rather than aggressive. The most important thing this year is not return. It is avoid losing money. Less is more. Risk less and fail less.’

– Property Soul, Let 4 traits of monkeys tell you properties in the monkey year

There are four reasons why adopting a defensive strategy is critical during uncertain times:

Reason 1: It’s risky to buy when prices are dropping.

Never buy on the way down. You never know what’s going to happen next. You don’t want to buy today and see prices drop tomorrow. And no one can tell when the drop is going to stop.

A safe strategy for amateur buyers is to enter the market only when prices are picking up. A popular strategy of savvy investors is to enter the market when they foresee that the market will be recovering soon.

Reason 2: It’s painful to get stuck with a wrong investment.

Unlike stocks, real estate is an illiquid asset. You can dump your stock the next moment. But the process of selling your property can take months or years depending on when you can seal the deal.

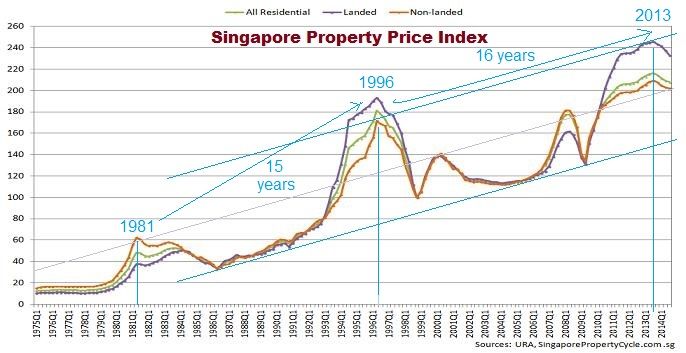

If you buy at the wrong time at the wrong price, it can take many years to breakeven. The URA Property Price Index only shows the average price of all caveats lodged, but magically hides all the deviations. Many people who bought during the last peak of the market in the mid-1990s took almost 20 years to breakeven.

While your cash is all tied up with an overpriced property, you wish you could have the means to buy during the low of a property cycle. Not only are you paying the price of buying at the wrong price, you are also paying the opportunity cost by failing to grab the good deals in a buyer’s market.

Reason 3: Prices can drop more than rent paid or collected.

Don’t complain that you have been paying rent for years while waiting for prices to come down. If you are renting for $3,000 a month, you are only paying $36,000 a year and $108,000 in 3 years.

If you bought a $1 million property, with its value down 10 percent you would have lost $100,000. This is on top of all the stamp duties, legal fee, mortgage interest, management fee, property tax, renovation and repair costs. Did’t you just negotiate with your landlord for a 20 percent cut to renew one more year for your tenancy?

I hope your landlord have bought the place a long time ago and have already paid off much of the mortgage. Otherwise the humble rent collected from you may be barely enough to cover the expenses. A gradual decline of the property’s value can also wipe up whatever rental return collected in the past few years.

Compared with your landlord, you choose to put your $1 million in a fixed deposit account with 2 percent interest. You have done nothing but safely collect $20,000 every year to subsidize half of your rent. So what do you have to complain about?

Don’t let hotspots become hot potatoes

As the back was getting crowded, people started standing on the empty spaces on both sides of the seminar area. Exhibitors from nearby booths also came to see why this only female speaker of the 2-day seminar was drawing a crowd here.

I repeated what I have emphasized during my presentation at the Properties in Year of the Monkey networking luncheon in January – the five things to avoid buying in 2016:

• Properties that promise unrealistic returns.

• Properties that you can’t really afford.

• Properties with no distinctive advantages.

• Properties with obvious problems.

• Properties selling at market price.

As expected, many snapped a picture with their mobile phones on the slide “Where to find good deals?”. I took three questions from the audience and the time was up.

After I walked down the stage, some from the audience continued to ask questions. The organizer reminded us to move elsewhere to clear the way for the next session. I suggested to go to the MPH booth to continue the Q&As since they were selling my book No B.S. Guide to Property Investment there.

We ended up using the table and chair in the booth for autographs and selfies. I haven’t done this for a while after the book was launched almost two years ago. I was really grateful that I still could sign eleven books in total.

When I got home, my daughter came over to me with her homework. She pointed at the parent’s signature stamp and said,

“Sign here.”

“No, hold your book like this. Look at me with your anxious eyes and ask politely, ‘Could I have your autograph please?'”

“Certainly,” she replied with a wink.

Reply With Quote

Reply With Quote