Not all your close friends are in the best of financial health.

That you can agree with me.

If you know that your friends need to cultivate better personal finance practice, how would you go about persuading them?

I see this question being put out a lot and honestly, I have brought zero people in real life to see the light financially.

So I am honestly quite a failure in this but as a financial blogger, I would like to provide some helpful advice if you are in the same position as I was some years ago.

People have too much Baggage

And because of this mental and circumstantial baggage, there is a large inertia to do something.

We all have a set of belief and values that shape our identity.

For most people, that is tough to change.

We are also adjusted to a lifestyle that wants seem to be a need.

If your friend has credit card debt, the sensible thing is to cut some of your expenses. However, if every want you to have, you believe they are a need, you cannot find ways to optimize and cut.

The same can be said about putting away 50% or more of your take-home income and set them aside.

Most people cannot separate what is a need from a want. Its also hard to leave that lifestyle.

Thus, convincing people to practice better personal finance habits tend to be futile.

It is better for them to get around this topic.

Usually, it is when things are too late.

You hope that it does not get to this situation but most of the time people will:

get so badly in debt that there is no turning back

reach age 40 to 45 and realize that they cannot get themselves out of a working run

reach 50 and realize they didnít build any wealth

Perhaps I saw enough examples, and my enthusiasm has diminished a lot.

Inertia is strong. If it is not broken donít change it. Everyone seems to be doing the same thing so things are not really that bad.

If you want to Subtly Convince, Make it About You, Not About Them

Your friends and family tend to notice your behavior, and that becomes a conversation point.

When someone asks why you donít spend on this and that, try not to make it about them.

Make it that it is a personal choice with a personal reason for yourself.

For example, if they ask you why you do not go for a holiday in Europe, and that you know they just went for something similar, donít go about saying its a bloody waste of money.

Perhaps explain you are allocating money to buy something big. They would be intrigued what is it (perhaps a rubber doll, an inflatable Takeshi Castle or an Audi A6)

It provides the starting seed to explain you are buying a specific kind of life.

If you tell them its a bloody waste of money, their defenses get up, it becomes difficult to get your point across.

This is the same when people ask me why I prep my own food. I donít go around saying the food outside is unhealthy and expensive! You are basically creating a you versus them situation.

I am sure they will empathize with you if you say you are trying something new and to see whether you can cut down some body fats.

The finesse of how points are put across is rather important.

Use the Influence of Crowds

If there is a culture of thrift and focus on money in your circle of friends, it becomes easier to influence one or two person.

If you are trying to influence a larger group, things donít usually work out.

The environment can be a very powerful factor when it comes to building wealth. Many people got out of debt or started investing because of peer pressure. It is only helpful when the peer pressure is for something good.

Unfortunately, only in certain circles will money be discussed. The topic for most people tend to center on not having enough of it and the only way to get better is through getting a better salary.

To use crowds in your favor, you can make them identify with the average crowd or not identify with the average crowd at the right situation.

For example, they should know that majority of the people are saving much less, such that non-working retirement is out of touch for them. If he saves as much as the average, that is not a good situation to be in.

In another instance, the majority of wealthy folks tend to practice particular habits.

Which group they want to identify with, is up to them.

Formally find out some ways to lay out your argument to achieve more effective results

I find that, whether your friends eventually get intrigued to find out more about living their life in a new way depends on your persuasion skills and how far they are from the illustrated situation.

This means that even though you have all the facts, and they are sound, not getting the point across will not let them see another way of life.

(This is why wealth management stuff has to be sold by persuasive wealth management ads and representative. Most of us do not see the value and therefore will not take it up or will put away too little of their income)

Some of my friends can be persuasive and influential.

What learnt from some materials that I read is that you have to be aware of whether your friends are more connected to facts and details or big picture.

How you choose to illustrate, the level of details will determine the results.

I find that having visual aids such as tables and videos gets the point across better.

Hereís how you could explain the Appeal of Saving

One common problem that you may face is persuading someone to save more.

I find that the saving word is not very necessary:

You save, to spend on something later

If you donít spend, you are buying something else (a lot of times you are buying financial security)

Money has a job. We are merely allocating it

Thus, there is the right conversation is not asking them to save more.

The right conversation is what sort of life do they want to live?

If we discuss this topic, you could always interject scenarios that they have not thought of, some scenarios that are so drastic that if you do not allocate well for that scenario, their ideal life do not become so ideal.

A lot of times what appeals to people is freedom.

The idea about the level of freedom they can enjoy depends on a formula that you can explain (formula here).

The next aspect to discuss is the income or take home income. You will be surprised how many of your friends know how much they take home a year. This part could be difficult to discuss with your colleagues since HR doesnít like you to discuss and compare pay.

Options of Wealth - The Possible Cash Flows

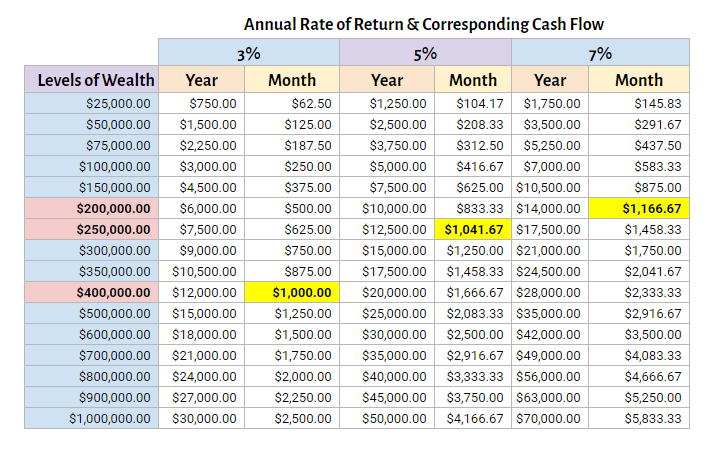

The table above shows the amount of cash flow that you can possibly generate with the level of wealth you have accumulated. There are 3 different rate of returns, and I have listed the annual and monthly amount.

passive income wealth machine for financial security

A wealth machine based on investing well in REITs achieving a cash flow of $20,000 through dividends with a capital of $400,000 preserved

The Message: If they put their money away, they are slowly buying a wealth machine that generates a recurring cash flow to diversify their work pay, possibly pay for a portion of their life.

Whether this appeals to them, will depend on your friendís annual income level and how much wealth is required to generate a cash flow that is meaningful to him/her.

For example, in the past, if you tell me that I could have $500/mth, I can think about potentially offsetting my monthly meal, personal utilities, transport with that.

If I earn $45,000/yr and take home $36,000/yr, to build up $75,000 to $100,000 to gain that cash flow at a 7% rate of return does not look so far away.

This part of the conversation will bring up discussion on:

how possible it is for them to get $75,000 to $100,000 fast or at moderately fast pace

what can this amount of cash flow do?

will this cash flow run out?

how do you possibly generate returns at 3%, 5% and 7%?

A large part of the discussion will pivot to their existing cash flow. And thus the discussion can pivot to understanding their cash flow versus perhaps your own cash flow.

This will entail a discussion of the personal cash flow statement (read my article on the personal cash flow statement here).

This will also entail a discussion on different ways of wealth building.

We will also discuss on optimizing expenses, increasing income.

This is lengthy, and if it gets to this point and they still want to sit down and hear more, then perhaps you manage to trigger your friend to this way of thinking.

Be the Best Version of Yourself

People with problems will broach the subject to someone they see as the subject matter expert.

So if you would like to help your friend, be that subject matter expert.

It can only benefit you if you progress along this path.

http://investmentmoats.com/uncategor...ial-situation/

Reply With Quote

Reply With Quote