Bigger homes back in demand

Oct 4, 2020

Families need more space as work-from-home culture sets in

Tan Ooi Boon

Invest Editor

https://www.straitstimes.com/busines...ck-in-demand-0

If you are feeling a bit cooped up working from home in your two-or three-bedroom unit, imagine how your horizon would be further curtailed if your living space was reduced by half or more.

Add another home worker - your spouse - and there is bound to be daily jostling on who gets more elbow space at the dining table. And we have not even talked about the kids yet, as they are bound to want their own playing area.

The work-from-home culture brought about worldwide by the pandemic has already changed how space is used in commercial buildings and shopping malls.

In the United States, for example, developers of mixed residential and retail developments have started replacing retail space with restaurants, as more people are expected to be at home.

While the use of commercial space in Singapore has yet to see major changes, recent figures of condominium sales here suggest working from home is starting to influence how families choose residential property.

The data shows a drop in the demand for so-called shoebox-size apartments - those under 500 sq ft - in the second quarter. These units accounted for only 10 per cent of total new transactions, down from 14 per cent in the first quarter, when most office workers were still on site.

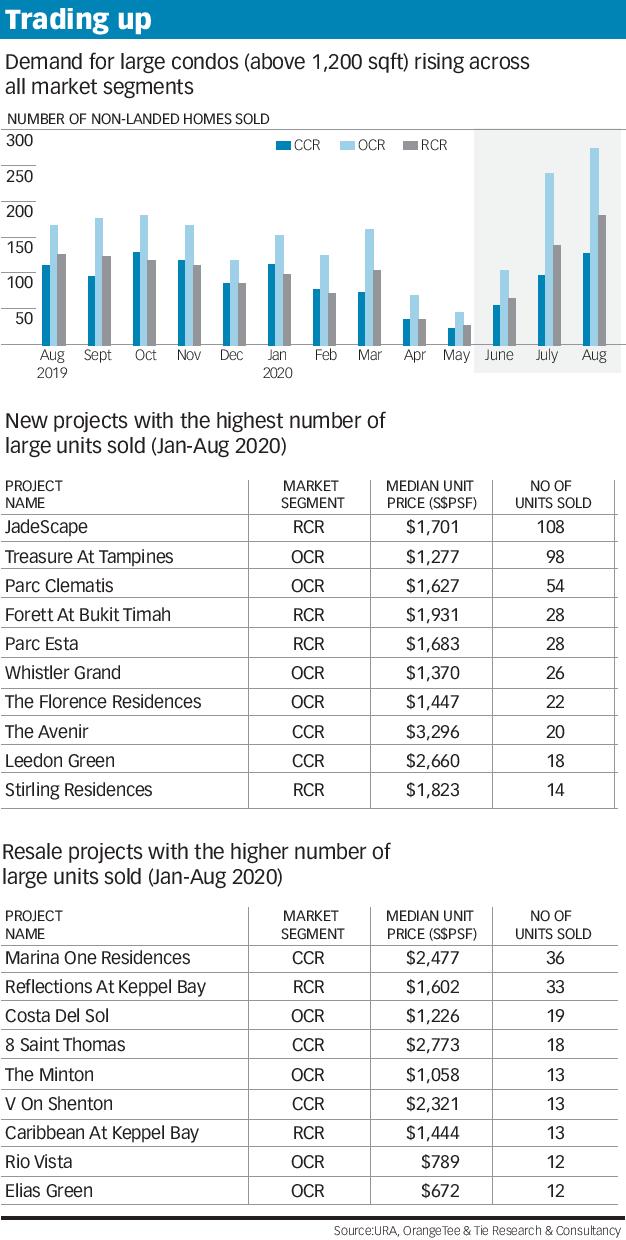

On the flip side, the demand for units 1,200 sq ft and above has risen.

For the first time since January last year, the monthly sales of bigger units exceeded 100 - hitting 112 in June, 125 in July and 151 in August.

Similarly, the take-up rate for resale condominium units, which are generally bigger than newer ones, has also shot up. There were 112 resale condo units sold in June, the month when the circuit breaker ended.

That shot up in July to 337 and 397 in August, which was the highest monthly number since January last year, notes Ms Christine Sun, head of research and consultancy at OrangeTee & Tie.

She says that as many people are spending more time working at home, they will certainly start to look at their apartments differently, and not just as a place to live and be with their families.

"We have noticed more people buying bigger homes lately and an increase in inquiries for homes in the suburban or city fringe areas," Ms Sun adds.

"Perhaps these people are now more acutely aware of the need for a bigger unit to set up a dedicated workspace or small office at home."

As bigger units tend to be pricier, some people are moving farther out to suburban and city fringe areas to find more affordable units. This probably explains why the demand for resale condo units has gone up significantly in recent months.

Many new condo units are built smaller to make them more affordable.

Depending on the location, the price per sq ft of new leasehold units can easily be over $2,000, meaning that a new three-bedder of about 1,000 sq ft will cost around $2 million, while two-bedroom units measuring 700 sq ft will go for $1.4 million or so.

As a comparison, older leasehold condo units can have a lower valuation of around $800 to $1,200 per sq ft.

So, even if someone is looking to buy a bigger unit of about 1,200 sq ft, it will still be cheaper than a new condo unit at $1.44 million.

But buying resale condo units to live in will often mean setting aside a budget for renovation.

However, the overall cost is still likely to be lower even if you factor in an extensive makeover budget of $100,000 to $200,000.

Those who buy bigger units are likely to have plans to make their homes more comfortable for work and play. Ms Sun notes: "Some may also want an extra room or study area to create a more conducive work space to facilitate virtual meetings or set up more complex equipment at home.

"Others may want to segregate or create clearer space boundaries between work and leisure as the lines could be blurring for some individuals."

So, does this mean that units below 500 sq ft have lost their shine?

It depends on the potential buyer.

Younger Singaporeans who have grown up in more spacious Housing Board flats might shy away from such units if they are planning to start a family.

That said, smaller units in prime areas in the city centre are likely to still command a premium for Dink (double income, no kids) couples who prefer location over anything else.

Property analyst Ong Kah Seng has another take on the demand for small units. When the pandemic subsides, buyers from Hong Kong, who are used to living in much smaller units, may be keen to look at such apartments.

"Moreover, prices of properties in Singapore are significantly lower compared with Hong Kong. Even if you include the additional stamp duty for foreign buyers, the price is still easily digestible," he says.

For instance, a foreigner who buys a suburban shoebox condo unit for $700,000 will have to pay an extra $140,000 in stamp duty.

Ms Sun notes that the work-from-home trend will change the way developers design new condominium blocks.

Instead of building more communal facilities like pavilions and barbecue pits in condo estates, they may add co-sharing spaces such as reading and work rooms equipped with Wi-Fi or 5G.

They may also build more units with study rooms, carve out dedicated spaces or create convertible areas within the apartment to set up a home office. Dual-key or Soho (small office, home office) units may also gain more popularity, Ms Sun says.

Work aside, if you are living in an older HDB flat or condo unit that is likely quite spacious, you may want to think harder about what you need before you upgrade into a new but smaller home.

Mr S.L. Wong, 54, and his wife used to live in an older condo unit of about 1,100 sq ft before moving two years ago to a fancier unit of about 700 sq ft.

They immediately missed the storage space. The couple are golfers but they now have to leave their golf bags in their car as there is not enough space at home.

"Regardless how good your interior designer is, square feet can't lie. However, housework is a breeze," says Mr Wong.

They are now looking forward to moving into a new and bigger unit of about 1,000 sq ft at the end of the year. Having learnt from their experience, their new home has a bigger kitchen, as the pandemic has resulted in them eating at home more often.

"We also chose a three-bedroom (unit) so we could design one spare room as a walk-in wardrobe to give us sufficient space to store all our stuff under one roof."

Buy only if you need a home to live in

All of us will be in two minds about whether it is a good time to buy a property given the economic turmoil we are going through.

Some have already decided: New home sales hit an 11-month high in August, with 1,227 private condominium units sold despite growing unemployment.

If you are buying because you need a home to live in, the answer must be "yes" because, unlike other kinds of investments, you get to enjoy living in a new home even if the recession is prolonged.

If you can afford it, the recession will enable you to drive a hard bargain to get the seller to offer a bigger discount. Also, mortgage rates are at their lowest in years, at just over 1 per cent at some banks.

But if you are thinking of buying for investment, think twice unless you have deep pockets.

This is especially so if you plan to lease out the unit and use the rent to pay the mortgage.

The reality is that you may not be able to find tenants in this market unless you offer a big discount on the rent, meaning you will need extra cash for mortgage payments.

Ms Christine Sun of OrangeTee & Tie says: "We have already seen a substantial slowdown in rental demand over the past few months. Further, as the current jobs support schemes are intended to help firms retain their local workforce, it is inevitable that a cutback in foreign employment will adversely impact the leasing market temporarily."

Property analyst Ong Kah Seng agrees. He says that buyers need to be more cautious because it is not just whether they can afford to buy.

"You should purchase a property only if you can use it for your own stay, as condo leasing demand will be inevitably weak for quite a while," he says.

What about buying property with the hope of capital gains down the road? After all, many people who bought in the past have enjoyed good returns.

Take a buyer who picked up a three-bedroom unit on Sentosa in the mid-2000s for about $800,000. That apartment would now be worth $2 million to $3 million. Even suburban condo units priced around $600,000 then would be worth almost double today.

So if you buy a new two-bedder for $1.5 million today, can you expect to sell it at $2 million, or even $2.5 million, in 10 to 15 years?

You can certainly hope so, but the reality is this will happen only if the post-pandemic world suddenly booms and everyone's income starts to shoot up.

As in all cases, the property market can see a meteoric rise again only if everyone's income also rises. But you should not look at past performances of property prices as indicators of the future.

Take the resale market today.

There are many resale condo units in prime districts that have been on sale for the past few years with price tags ranging from $1.8 million to $3 million. Many of these freehold condos are within walking distance of Orchard Road.

Some of the 1,000 sq ft units are selling at about $2.4 million, which works out to be around $2,400 per sq ft. Considering that these freehold units are just a short stroll away from popular malls such as Takashimaya, Ion Orchard and Paragon, they should give new leasehold suburban units, which are priced at $2,000 or more per sq ft, a run for their money.

But there are often no takers for many of these good units near Orchard Road.

There are two reasons why these properties have remained on the market for the past few years with little change to their asking prices.

AFFORDABILITY

Let's face it. The moment the price goes beyond $2 million, many buyers will drop out because it will exceed their budgets.

What about the ultra-rich buyers? Many are not keen on these "small" units as they prefer to live in mega ones that probably cost $10 million or more.

Also, they may be the ones selling these units, which were bought earlier at far lower prices.

So this stalemate in the $2 million segment of smaller units raises the question of whether many of the new smaller $1.5 million suburban condo units that are sold today will see their prices rise beyond $2 million.

It is unlikely unless the earning power of today's young people exceeds that of their parents in a decade or two.

NEW VS OLD

As cars in Singapore have an "expiry date" of 10 years, many Singaporeans have grown used to buying new cars instead of second-hand ones.

This preference for new purchases has somehow spilled over to property as well.

Any young couple asked to pick between a new property and a resale one will likely choose the former even though the latter may be a cheaper and better deal.

This begs the question - if everyone seems to prefer new properties, who will then buy today's new units in 10 years?

And if the demand for older properties starts to wane, how can owners continue to reap capital gains?

Perhaps a paradigm shift in the real estate market is needed, with developers taking a leaf from the book of car distributors such as Cycle & Carriage and Performance Motors.

While parallel imports are available, many still choose to buy from authorised dealers because they will continue to service and repair the cars with genuine parts.

With the same business model in mind, if major developers opt to also be the managing agent of the properties they sell, perhaps it will make their units even more desirable.

Imagine the scenario of owners turning to the developer for all kinds of needs, including renovation, repair, maintenance and even buyback of units for resale.

This could provide a sustainable new revenue stream for developers, instead of just relying on building and selling new units, a process limited by the availability of land.

So other than just banking on location, here is a chance to create a new badge of honour - developer-managed condo.

Reply With Quote

Reply With Quote